Corporate Missions and Fiduciary & ESG Principles

Nikko Asset Management Co., Ltd. (“Nikko AM”), as an asset management company, acts as a fiduciary on behalf of its clients and is firmly committed to putting its clients’ best interest first. It places fiduciary and ESG principles at the highest guiding theme of its corporate value and actions.

Nikko AM strongly believes that investments by considering environmental, social and governance (“ESG”) are inherent to long-term corporate value creation, and contribute to the realization of sustainable economic growth. As such, Nikko AM views ESG issues as an integral part of its fiduciary duty and endeavours to incorporate ESG principles in all its investment processes.

Nikko AM, for the realization of high-quality financial services that truly meet clients’ needs, always endeavours to act in the spirit of the fiduciary and ESG principles, and continually makes effort toward further improvement with the ideas of innovation.

Code of Conduct Regarding Fiduciary & ESG Principles

21 November, 2016

Fiduciary principles are at the heart of Nikko AM’s asset management business, and the highest guiding theme behind Nikko AM’s management philosophy for maximizing investor interests.

1. Higher-Quality Investment Management

Basic Guidelines

- High-quality asset management services provided by true investment professionals

- Efforts to enhance the governance structure and activities as an institutional investor fulfilling ESG, the Stewardship Code, and other responsibilities

Detailed Measures

- In relation to exercising voting rights in investment-target companies, setting up a supervisory committee with a majority of outside members, and monitoring to ensure that voting rights are exercised in line with true investor interests

- Taking measures to attract, grow and retain skilled investment management professionals to provide high-level investment management techniques and analytics, and to pursue investment opportunities

- Having a middle office structure in which monitoring, performance and risk assessment of investment management is conducted by departments that are separate from the Investment Fund Management Division, and to optimize investment management by providing constant feedback, etc. to the Investment Fund Management Division

- When engaging external investment management companies, ensuring strict monitoring and evaluation of performance and operations via a department specialized in monitoring of external investment managers

2. Product Development Always Aimed at Maximizing Investor Interests

Basic Guidelines

- High-quality product development that maximizes investor interests and responds to diversifying and changing investor needs

Detailed Measures

- Preparing documents for customers and providing explanations to investors, with emphasis on easy-to-understand investment policies, product risk characteristics and fee transparency, etc.

- Having a product development process that includes a system of rigorous checks from all appropriate angles, including risk analysis, compliance and operations

- Ensuring strict screening processes that reflect changes, etc. in relevant domestic and international laws, regulations and market environments, etc.

- Leveraging Nikko AM’s investment management knowhow and international network of group companies to provide a customer-focused, solutions-based business

3. Stronger Corporate Governance

Basic Guidelines

- Cultivating a strong culture of compliance and establishing compliance processes

Detailed Measures

- Constantly working to have an organization that is structured around prioritizing investor interests and to have the highest standard governance in the industry

- Managing conflicts-of-interest

- Promoting early escalation and continuous information delivery

- Developing IT infrastructure for front office departments, using IT to improve business efficiency and guidelines as well as to eliminate administrative mistakes, and centralizing database development and report creation

- Ensuring appropriate management independence among group companies, and using outside directors to ensure the function of controls on management and management transparency

- Continued efforts to further strengthen corporate governance of overseas subsidiaries

Implementing Fiduciary & ESG Principles

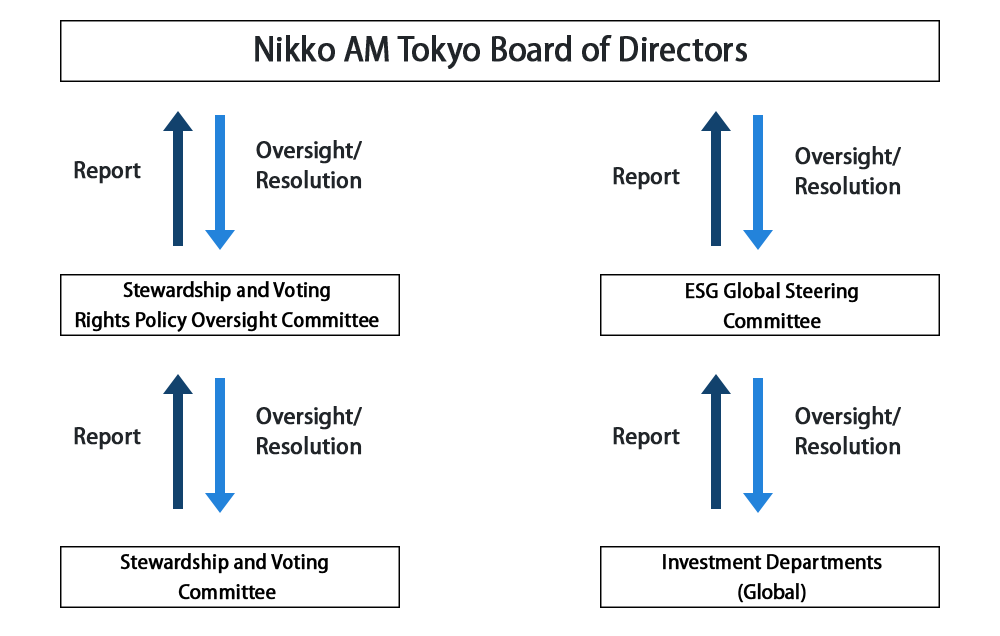

Fiduciary & ESG Principles are Nikko AM's highest guiding themes as an asset management company, and resolutions, reports, deliberations relating to them are all carried out at meetings of the Board of Directors.

(Stewardship and Voting Rights Policy Oversight Committee consists of a majority of outside members, including the Chairman)