Global Fixed Income

Philosophy

We believe in employing a consistent investment process that incorporates quantitative and qualitative inputs to generate ideas and construct high-conviction portfolios, where we get suitably rewarded for the risk we undertake. Bond investors have a unique opportunity to identify risks, engage issuers, and build relationships that can influence change. At Nikko Asset Management, we see ourselves as capital allocators and we intend to continue our efforts to provide the capital needed to meet the United Nations Sustainable Development Goals. We believe it is our responsibility to create innovative products and strategic partnerships across the capital market structure that will establish pathways for meaningful flows into sustainable investments.

ESG Implementation

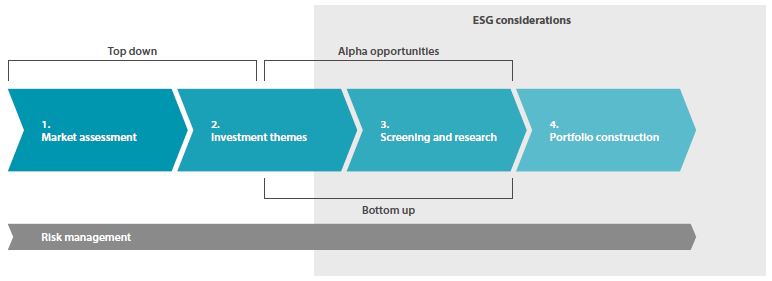

ESG is considered across all of our products. In the investment process, ESG is applied at the screening and research stage, and the portfolio construction stage. The scale and manner that ESG is integrated depends on product expectations.

For example, our flagship green bond strategy strictly invests in green bonds issued by global AAA-rated sovereigns, supranationals, and agencies (SSAs) with the strongest sustainability credentials, such as the World Bank, European Investment Bank, and Asian Development Bank.

Another example is how our Global Credit team implements ESG within their investment process. While most experienced analysts work with a best-practice list for corporate governance, built on the back of many years of experience in credit investing, it is often more difficult to form an opinion on the environ-mental and social aspects of a business. Corporate governance assesses mostly general management quality, which has a direct impact on a company's performance, while environmental and social assessments tend to capture risk and opportunities linked to a specific industry or region. The impact on performance might be marginal, indirect, and long-term for environmental and social factors. However, the investment team ensures that the investments correspond with the ethical and social values of an increasing number of institutional clients. European asset owners, in particular, require that these values are reflected in their portfolios, alongside companies' performance goals. We believe a team of skilled and experienced credit analysts is still the key to success for ESG to be integrated in the analysis. Our analysis is also supported by third-party ESG research, which we use to develop a screen to identify possible issues that may warrant further research.

Four steps of our ESG implementation framework