Japan Equity

Philosophy

To generate new growth, companies today must have a strong approach to ESG. By investing in the stocks of such companies, we believe that excess returns can be achieved over the medium to long term.

The Japan Equity team aims to generate alpha by picking companies with superior ESG practices through a stock selection process that combines both negative and positive screening, and an optimisation process that incorporates thorough management of risks.

ESG Implementation

When we conduct a historical comparison between leading ESG indices and the TOPIX, it is apparent that ESG indices do not always outperform the market. This implies that investing in companies with superior ESG ratings on its own is insufficient for out-performance. Instead, a well-conceived approach is necessary when implementing ESG considerations. As with any investment, appropriate stock selection and portfolio management are crucial to improve performance and control risk within an ESG strategy.

The Japan Equity team believes that a superior ESG investment process should:

- Pursue alpha through a combination of financial and non-financial information, including ESG

- Focus on ESG factors that lead to future earnings and strengthen competitiveness

- Involve consistent engagement with corporate management teams

CSV evaluations of individual stocks: Positive screening

All Japan equity active investment strategies incorporate Creating Shared Value (CSV) evaluations*, which take ESG factors into consideration. It is a comprehensive score that was developed by applying the CSV theory proposed by Harvard University professor Michael Porter. The score assesses how companies balance their engagement of ESG issues on one hand, and the pursuit of profitability and competitiveness on the other, in order to create value for both society and shareholders. Our analyst research has incorporated CSV evaluations since 2013.

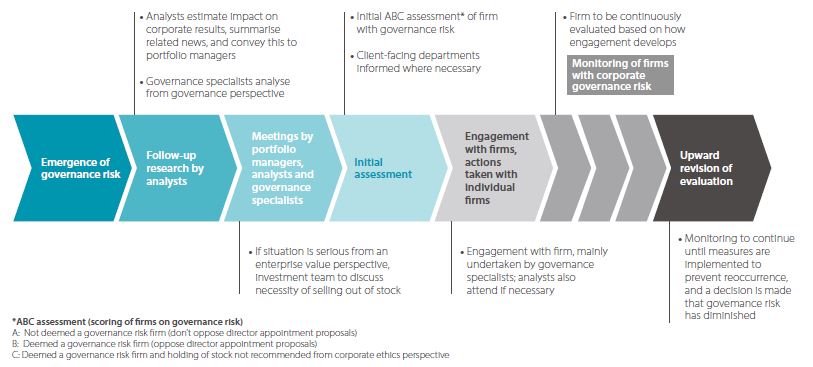

Approach to firms with governance risk: Negative screening

Firms that have been involved in criminal conduct/fraud and/or accounting fraud, or that have caused environmental or social problems, are classified as having governance risk. The Japan equity team excludes firms with perceptible corporate governance risk from its investment universe, while also seeking to promote better governance by engaging with the firms it invests in.

Operational flow for handling firms with governance risk