Japan Fixed Income

Philosophy

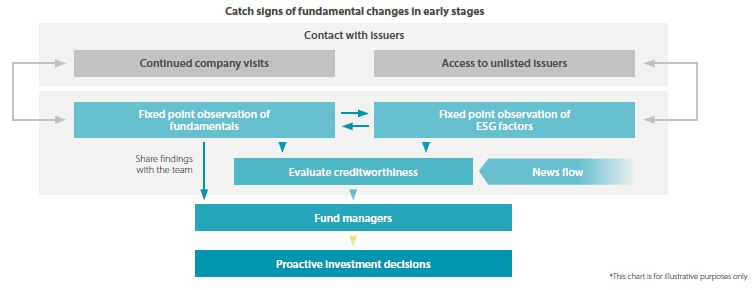

In order to pursue excellent performance in domestic bond management, it is critical to evaluate creditworthiness by analysing both quantitative risks, such as debt repayment ability, and qualitative risks that cannot be captured by financial analysis. The environmental, social, and governance (ESG) viewpoint is positioned as an important factor in qualitative risk analysis.

In our team, credit analysts who analyse creditworthiness perform both fundamental analysis and ESG factor analysis of individual issuers. ESG is incorporated into the investment process by comprehensively evaluating both the fundamentals and ESG of the industry/issuer and reflecting it in investment decisions.

ESG Implementation

We have set out eight items (two items related to the environment, and three items each related to society and governance) in analysing ESG factors. Credit analysts are required to evaluate these ESG factors alongside fundamentals in the issuer report. In addition, we share ESG views within our team at monthly meetings attended by fund managers and credit analysts. We believe that frequent conversations on ESG support a process that allows us to promptly reflect a change in circumstances that negatively affects creditworthiness, including ESG events.

For green bonds, our team considers performance contributions to be the primary investment criteria and will conduct the same robust level of research on creditworthiness of the issuer as we would for a regular bond. Regarding security selection, we prefer investing in securities that have been certified by third-party organisations and that are expected to yield higher returns.

For example, we invested in a green bond issued in 2018 by Japan's first real estate investment corporation (REIT). We arranged a meeting with the issuer before investing and determined that the green bond issuance could have a positive synergistic effect on the issuer's fundamentals, such as proactive efforts for green-eligible assets and the introduction of green leases.

We will continue to contribute to the expansion of the green bond market by suggesting green bonds to potential issuers based on their business structure or asset characteristics.

A recent observation we have made in the Japan credit market is the increase of SDG bonds that can address not only environmental but also social issues. While the number of issuances, especially those by corporates, is currently low, we decided to purchase one that was issued by a Japanese shipping company. Through our regular communication with the company, we strongly believe that we have deepened our understanding of its social and environmental initiatives and that these will have positive synergy with its fundamentals.

A framework that catches momentum change